Dow reaches a new high

- Tuesday, October 03 2006 @ 02:47 PM CST

- Contributed by: filbert

- Views: 2,316

|

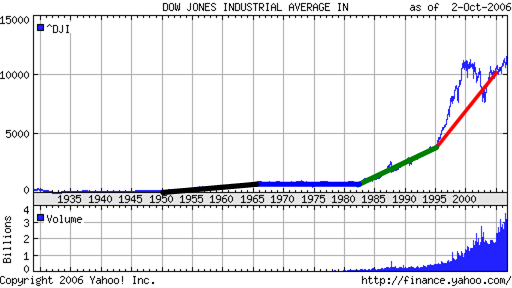

This graph from Yahoo Finance (via FreeRepublic) shows the Dow's history since 1930. |

It appears to me that the Dow's chart since The Crash of 1929 can be differentiated into five distinct periods.

The first period from the 1929 crash until about 1950, is relatively flat. There's a bit of an uptick after the end of the war. This is generally considered to be a time of great technological innovation, but it wasn't, really. The same technologies which existed at the beginning of the period--the propeller-driven airplane, the automobile, mass production, radio, etc. were also dominant at the end of the period. But change was just around the corner.

The second period, indicated by the black line, is the "postwar boom" which ended around 1966. During this period we went from prop planes to jets, from radio to television, from two-lane highways to Interstates, from computation engines to mainframe computers, from V-2's to the Saturn V.

The third period, the thick blue line, is another flat period. Again, there is really little technological change from the beginning of the period to the end. Most people lived their lives in 1980 not too differently than they did in 1966, really. But that would soon change. (My own bias is to also attribute the relatively flat performance to the impact of the Great Society/Welfare/Medicare on the economy. Socialism is rarely responsible for economic growth.)

The fourth period, the green line, looks to me to coincide with the personal computer--let's call it the first-phase information economy. Personal computers really began to impact productivity in the early 1980's. Probably not entirely coincidentally, "Reaganomics" began to kick in around 1981-1982.

The fifth phase, in red, is interesting. You can easily see the "dot-com bubble" from 1995 to its peak in 2000. But if you look at 2003 to date, it looks to me that there was an underlying expansion going on. I'd call that the second-phase information economy, powered by Internet technologies and evolving generally much faster than the first-wave information economy.

I think you can make an argument that economic growth is directly related to the rate of technological advancement. This isn't a particularly radical thought. But with the Dow curve appearing to approximate a hyperbola, maybe it's time to look into the Singularity after all.