Independence Whip, July 2, 2010

- Friday, July 02 2010 @ 05:39 AM CST

- Contributed by: filbert

- Views: 2,249

Who Pays the Taxes

Distribution of Federal Taxes

The question is always framed as "the rich aren't paying their fair share." Well, what's fair? The only answer the "progressives" ever give is: "The poor pay less, and the rich pay more." That's an inherently unstable way to build a society--it ultimately leads to a permanent underclass--the ones without the money, and a permanent ruling class--the ones with the money. Eventually, the underclass catches onto the scam. Then you have revolutions.

Everybody needs to have some "skin in the game." When you have 50% of the population paying no income tax at all, you're starting to get into very, very dangerous territory, socially. That's where we are right now.

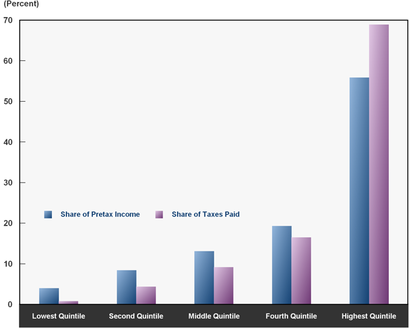

Who's paying their fair share again?

Distribution of Federal Taxes

The federal tax system is progressive--that is, average tax rates generally rise with income. Households in the bottom fifth of the income distribution (with average income of $18,400, under a broad definition of income) paid 4.0 percent of their income in federal taxes. The middle quintile, with average income of $64,500, paid 14.3 percent of that income in taxes, and the highest quintile, with average income of $264,700, paid 25.1 percent.

|

| who's paying their fair share again? |

|

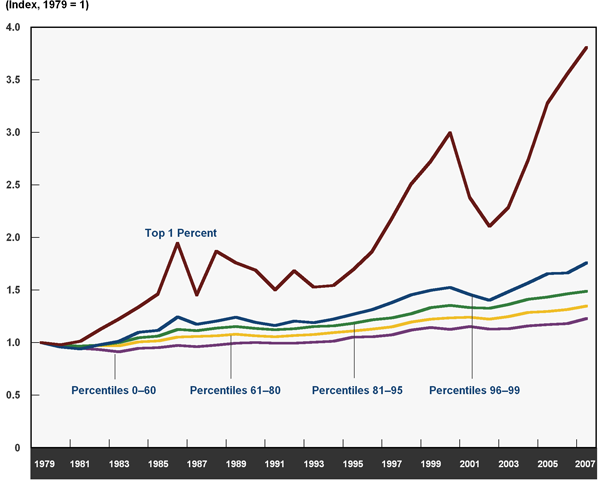

| Contrary to Democrat spin, the poor are NOT getting poorer. Their income was going up--not as fast as the wealthiest, maybe, but still going up . . . |

|

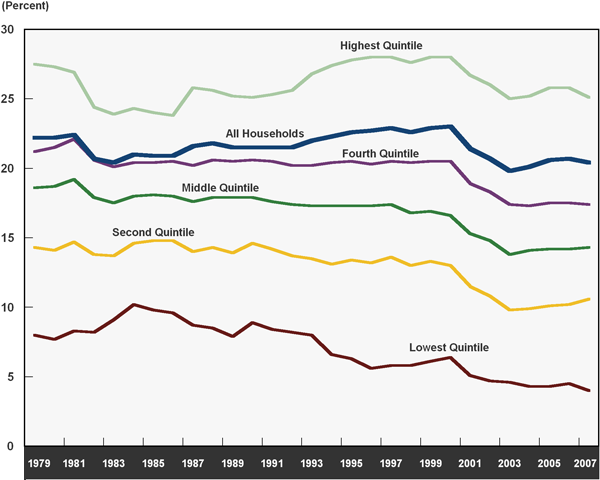

| But their proportion of the taxes paid keep going down. Yeah. Let's talk about "fair." |

The question is always framed as "the rich aren't paying their fair share." Well, what's fair? The only answer the "progressives" ever give is: "The poor pay less, and the rich pay more." That's an inherently unstable way to build a society--it ultimately leads to a permanent underclass--the ones without the money, and a permanent ruling class--the ones with the money. Eventually, the underclass catches onto the scam. Then you have revolutions.

Everybody needs to have some "skin in the game." When you have 50% of the population paying no income tax at all, you're starting to get into very, very dangerous territory, socially. That's where we are right now.

Who's paying their fair share again?